Sunday, Feb. 26, 2023–11:00 a.m.

-David Crowder, WRGA News-

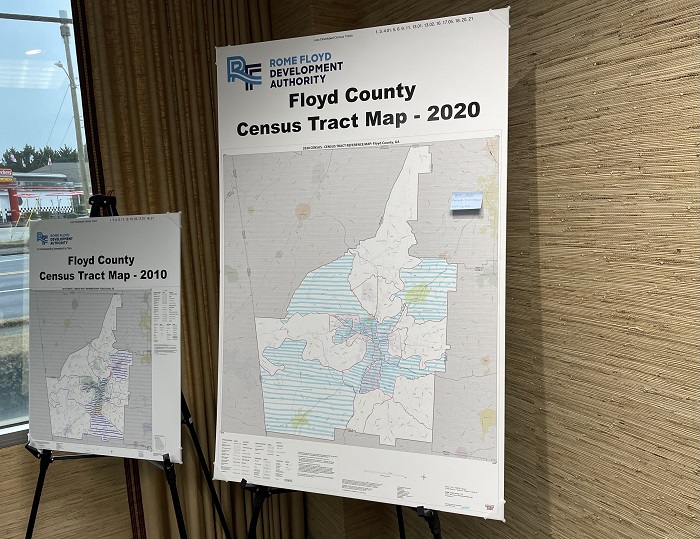

The State of Georgia offers statewide job tax credits through a tier status with the Georgia Department of Community Affairs. Although Floyd County is remaining in tier two for the second consecutive year, there are some areas of the county that have been designated less developed census tracts, meaning that industries that are located in those tracts get the same incentives as those in tier one.

Properties that are included this year in the less developed census tracts areas include Highway 411 where the Rome-Floyd County Development Authority acquired more than 200 acres in 2021, and the north side of Technology Parkway, where the development authority also has a lot of property for sale. Neither of these properties was included last year.

“With the job tax credit, if you create jobs in tier one or a less developed census tract, you get a $3,500 per job tax credit for five years in a row,” said Missy Kendrick, President and CEO of the Rome-Floyd County Development Authority. “You have to keep those jobs and there are certain other requirements such as wage rates and things like that.”

The money is first used to offset the industry’s Georgia income tax liability. Any leftover credit can be kept as part of their payroll withholding taxes.

“So, what happens is they withhold taxes as normal, but at the end of the year, instead of sending that money into the state, they are allowed to keep that money and reinvest it in their business and in their community,” Kendrick explained. “That’s a big incentive for industries.”

The job tax credits are available for any business or headquarters of any such business engaged in manufacturing, warehousing and distribution, processing, telecommunications, tourism, research and development industries, or services for the elderly and persons with disabilities but do not include retail businesses. If other requirements are met, job tax credits are available to businesses of any nature, including retail businesses, in counties recognized and designated as the 40 least developed counties.